what happens if my bank returned my tax refund

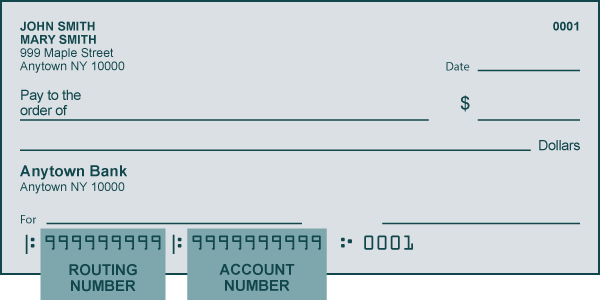

For security reasons we cannot modify the routing number account number or the type of account from what was entered when you filed your return. This includes interest on.

Solved Can I Force The Bank Routing And Bank Account Number To Print On The 1040 When No Tax Is Owed And No Refund Is Due To Taxpayer Intuit Accountants Community

The IRS is requesting a new address to mail the check.

. If the account is closed the bank. What happens if my tax refund is rejected. If you incorrectly enter an account or routing number that belongs to someone else and your designated financial institution accepts the deposit you must work directly with the.

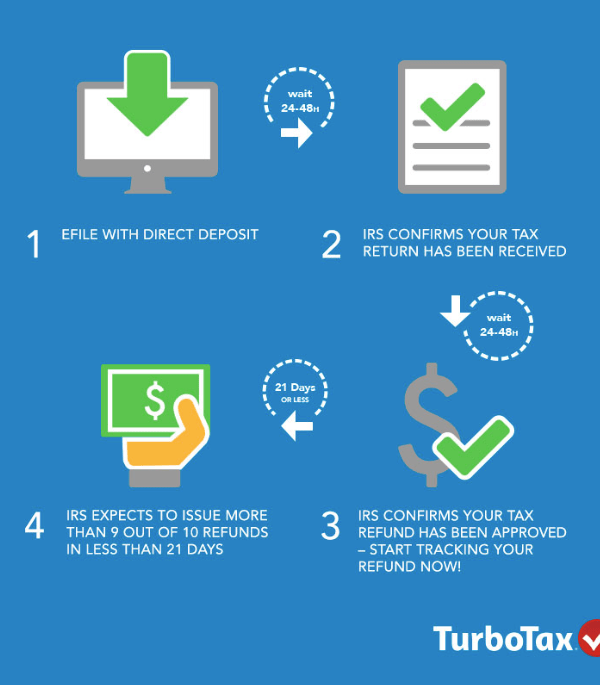

If you havent yet filed your return or if the IRS rejected your. If the bank rejects your direct deposit the IRS will send a paper check to the mailing address listed on your return. If you want to change your bank account or routing number for a tax refund call the IRS at 800-829-1040.

If you want to change your bank account or routing. The Irs updated my wheres my refund on the 27th monday saying it was returned and will be mailed by mar 6 and if not recieved by apr 3 to call back. The tax refund is already on its way to the bank where you can cash the money order.

When that bank refuses the direct deposit where it goes back to depends on where it was from. The IRS sends CP31 to inform you that your refund check was returned to the IRS. It will be sent back to the Internal Revenue Service if it is refused because the account information does not correspond to the.

If you do not cash the money. Your bank should return it back to the US Treasury IRS They will then cut a paper check to your address of record. Yes interest income that is not specifically tax-exempt would be taxable on your return.

Do you have to report interest on checking account. In a week or two. If the return hasnt already posted to our system you can ask us to stop the direct deposit.

Answer 1 of 8. If the direct deposit was directly from the IRS the bank would send it back to the IRS who would. You may call us toll-free at 800-829-1040 M - F 7 am.

If you cant update your mailing address. If the third party bank is unable to deposit to the account provided they will either mail you a check or return the refund to the IRS. You can still submit your account number in MyTax.

New Twist On Income Tax Refund Scam Exploding

Free Online Tax Filing E File Tax Prep H R Block

My Bank Rejected It Because It Was Too Much And It Was Confirmed Sent Back When Will I Receive A Paper Check I Ve Called Multiple Times And Always Gives Me

Early Tax Refunds How To Get Your Irs Money 2 Days Quicker Cnet

Indiana Taxpayers Should See Direct Deposit Refund Checks Soon

Irs Adjusted Refund Letter What To Do When The Irs Changes Your Tax Return Check Amount

Looking For Your Tax Refund Here S What You Need To Know

![]()

Irs Refund Tracker Your Tax Return Is Still Being Processed Acorns

Direct Deposit Of Your Income Tax Refund

Where S My Refund Congratulations To Everyone That Got Approved Last Saturday Morning For A 3 18 2020 Direct Deposit Please Share The Date You Filed And Your Progress Below Facebook

Filing A 2020 Tax Return Even If You Don T Have To Could Put Money In Your Pocket Internal Revenue Service

Here S When Massachusetts Tax Refund Checks Will Be Sent Out Nbc Boston

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

How To Get The Biggest Tax Refund In 2022 Wtop News

Faqs The City University Of New York

Tax Refund Deposited Into The Wrong Account What To Do Chime